A Biased View of Custom Private Equity Asset Managers

Wiki Article

Examine This Report on Custom Private Equity Asset Managers

(PE): spending in firms that are not publicly traded. Roughly $11 (https://www.imdb.com/user/ur173700848/?ref_=nv_usr_prof_2). There might be a few things you do not understand about the industry.

Private equity companies have a variety of investment preferences.

Because the very best gravitate toward the larger deals, the middle market is a considerably underserved market. There are much more vendors than there are highly seasoned and well-positioned finance specialists with substantial purchaser networks and resources to manage a deal. The returns of personal equity are typically seen after a couple of years.

Custom Private Equity Asset Managers for Beginners

Traveling below the radar of large international companies, several of these tiny business commonly provide higher-quality client service and/or specific niche product or services that are not being used by the big corporations (https://www.merchantcircle.com/blogs/custom-private-equity-asset-managers-abilene-tx/2023/12/The-Power-of-a-Private-Equity-Firm-in-Texas-and-Asset-Management-Group/2608142). Such benefits bring in the passion of personal equity firms, as they have the understandings and wise to manipulate such chances and take the business to the following level

Personal equity capitalists should have reputable, capable, and reputable management in position. Many managers at profile companies are provided equity and benefit settlement frameworks that award them for striking their financial targets. Such placement of objectives is generally required prior to a deal obtains done. Personal equity possibilities are typically unreachable for people that can not spend millions of dollars, yet they should not be.

There are policies, such as limits on the aggregate amount of cash and on the variety of non-accredited capitalists. The personal equity business attracts several of the most effective and brightest in company America, including top performers from Lot of money 500 firms and elite administration consulting firms. Law companies can likewise be hiring premises for private equity works with, as audit and legal abilities are necessary to total offers, and transactions are highly searched for. https://madgestiger79601.wixsite.com/cpequityamtx/post/unlocking-prosperity-tx-trusted-private-equity-company-and-private-asset-managers-in-texas.

A Biased View of Custom Private Equity Asset Managers

One more drawback is the lack of liquidity; when in a private equity deal, it is not easy to leave or offer. There is an absence of adaptability. Personal equity also includes high charges. With funds under administration currently in the trillions, personal equity companies have come to be eye-catching investment cars for well-off individuals and establishments.

Now that accessibility to exclusive equity is opening up to more specific capitalists, the untapped capacity is becoming a truth. We'll begin with the primary debates for investing in personal equity: How and why exclusive equity returns have historically been higher than various other properties on a number of levels, Just how including private equity in a profile influences the risk-return profile, by helping to expand versus market and cyclical danger, After that, we will certainly describe some crucial considerations and risks for personal equity financiers.

When it pertains to introducing a new asset into a portfolio, the a lot of fundamental factor to consider is the risk-return account of that possession. Historically, exclusive equity has exhibited returns similar to that of Emerging Market Equities and greater than all various other conventional asset classes. Its reasonably low volatility coupled with its high returns creates an engaging risk-return account.

The 30-Second Trick For Custom Private Equity Asset Managers

In truth, private equity fund quartiles have the largest variety of returns throughout all different possession courses - as you can see below. Methodology: Interior price of return (IRR) spreads out calculated for funds within vintage years separately and after that balanced out. Mean IRR was determined bytaking the standard of the mean IRR for funds within each vintage year.

The impact of adding exclusive equity into a profile is - as constantly - reliant on the profile itself. A Pantheon research from 2015 recommended that consisting of exclusive equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective private equity firms have access to an also bigger pool of unknown chances that do not deal with the same analysis, along with the sources to execute due persistance on them and determine which deserve buying (Private Asset Managers in Texas). Investing at the first stage implies greater threat, however, for the firms that do succeed, the fund gain from higher returns

article sourceMore About Custom Private Equity Asset Managers

Both public and private equity fund supervisors devote to investing a percent of the fund however there stays a well-trodden issue with straightening passions for public equity fund management: the 'principal-agent issue'. When an investor (the 'major') employs a public fund supervisor to take control of their resources (as an 'agent') they hand over control to the supervisor while retaining ownership of the assets.

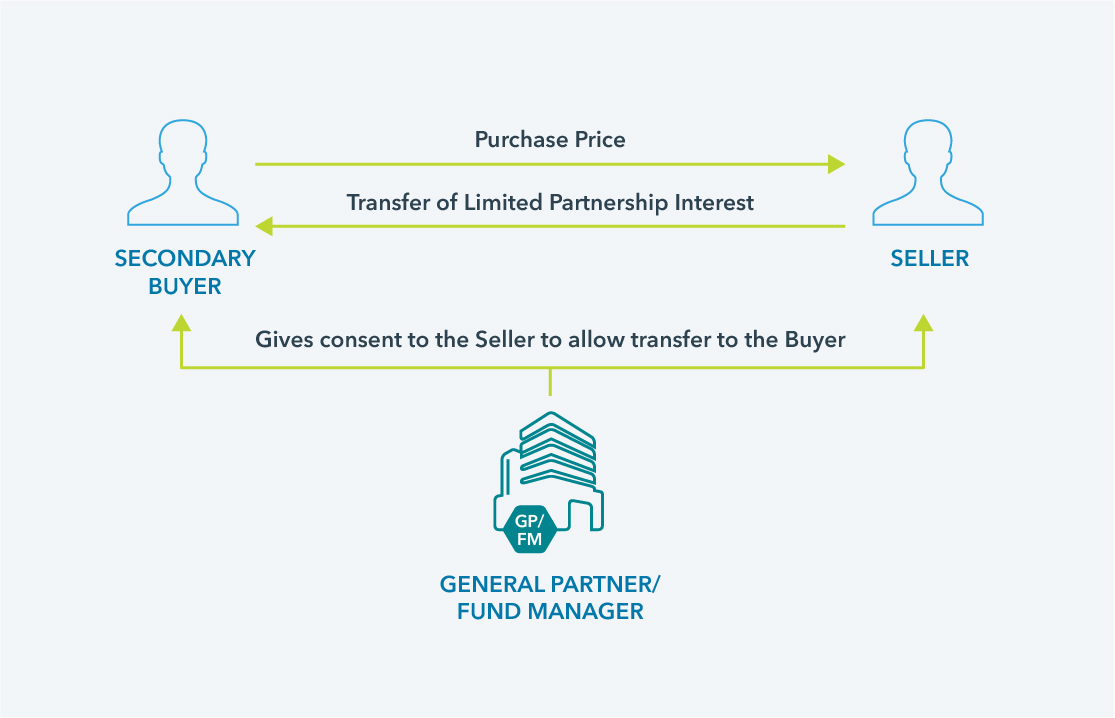

In the case of private equity, the General Companion doesn't simply gain a monitoring fee. Personal equity funds additionally minimize one more form of principal-agent issue.

A public equity capitalist eventually desires something - for the monitoring to increase the supply cost and/or pay out returns. The financier has little to no control over the decision. We revealed above exactly how many private equity strategies - especially majority acquistions - take control of the running of the company, ensuring that the long-term worth of the firm precedes, rising the return on financial investment over the life of the fund.

Report this wiki page